- HOME

- SHOP

- PRODUCT

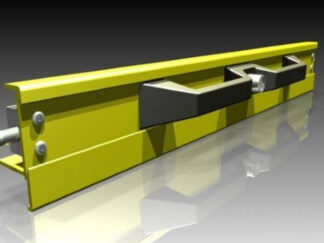

- General Purpose Container Slide Fully Locking/No-Lock <250kg

- Rolled Stainless Steel 316 & 304 Fully Locking/No-Lock <227kg

- Fully Locking Truck Base Mounts Pull-Out Trays & Bike Stowage

- Thomas Regout Quality

Drawer Slides: Steel <300kg - Professional Range C45 Steel Extreme Duty < 2,410kg

- Professional Range 316L Stainless Steel 1.4404 < 2,000kg

- Professional Range 6082 T6 Aluminium & Stainless < 330kg

- PRODUCT

- Saibo: Precision Hardened Steel Telescopic Slides <4,846 kg

- Radial Aluminium Cross Rollers: Aerospace AS9100-D < 400kg

- Aero BB Aluminum <350kg Aerospace/Defense Slides

- Fulterer Steel Roller Bearing Side & Bottom Mount < 200kg

- Fulterer 441 Stainless Steel 1.4509 NSF Approved < 120kg

- Fulterer Vertical Pull Out & Pantry Slides < 200kg

- Manual & Motorised Height Adjustable Screen Mounts

- PRODUCT

- PRODUCT

- Actuators – Gearmotors – Linear Motorised Units – Motorised Ball Valves

- Tilting Drawers For Fire Trucks – Tip Downs < 90kg

- Drawer Locking System, Locks & Handles < 500kg

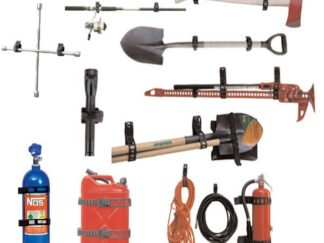

- Fire & Emergency Truck Stowage Solutions

- Professional Tool Clips & Equipment Mounting Brackets

- Home & DIY Projects

- Clearance Section- Further Reductions

- PRODUCT

- FAQs

- ABOUT US

- BLOG

- CONTACT

- LANGUAGE

Sliding Systems

Sliding Systems is a manufacturer and global distributor of telescopic slides, linear rails and drawer hardware.

We offer engineered solutions for the sliding, transfer and withdrawal from a few kilos to well over 4,000kgs.

We can ship direct to the customer anywhere in the world.

Our main website www.gsfslides.com hosts technical data and drawing packages for all items sold in this web-shop

Product Categories

-

General Purpose Container Slide Fully Locking/No-Lock <250kg (9)

-

Rolled Stainless Steel 316 & 304 Fully Locking/No-Lock <227kg (2)

-

Fully Locking Truck Base Mounts Pull-Out Trays & Bike Stowage (7)

-

Thomas Regout Quality Drawer Slide Range: Steel <300kg (22)

-

Saibo: Precision Hardened Steel Telescopic Slides <4,846 kg (9)

-

Professional Range C45 Steel Extreme Duty < 2,410kg (80)

-

Professional Range 316L Stainless Steel 1.4404 < 2,000kg (26)

-

Professional Range 6082 T6 Aluminium & Stainless < 330kg (12)

-

Radial Aluminium Cross Rollers: Aerospace AS9100-D < 400kg (9)

-

Aero BB Aluminum <350kg Aerospace/Defense Slides (11)

-

Fulterer Steel Roller Bearing Side & Bottom Mount < 200kg (7)

-

Fulterer 441 Stainless Steel 1.4509 NSF Approved < 120kg (16)

-

Fulterer Vertical Pull Out & Pantry Slides < 200kg (6)

-

Budget Linear Rail & Carrier: Steel/Stainless/Aluminium (20)

-

Saibo: Aluminium & Hardened Shaft Linear Rail (10)

-

Saibo: Induction Hardened Steel Compact Linear Rail (4)

-

Saibo: Precision Hardened Steel V Rail & V Ring (10)

-

Saibo: Hardened Steel Chromed Shaft g6 Ø 5-40mm (9)

-

Saibo: PTFE Linear Shaft Bushes Ø 20-50mm (2)

-

Actuators - Gearmotors - Linear Motorised Units - Motorised Ball Valves (67)

-

Manual & Motorised Height Adjustable Screen Mounts - BalanceBox® and e·Box® (9)

-

Tilting Drawers For Fire Trucks - Tip Downs < 90kg (4)

-

Drawer Locking System, Locks & Handles < 500kg (13)

-

Fire & Emergency Truck Stowage Solutions (108)

-

Professional Tool Clips & Equipment Mounting Brackets (61)

-

Clearance Section- Further Reductions (7)

We proudly supply our full product range to over 80 countries, directly from our UK warehouse or European manufacturing facilities, with subsidised airfreight as standard **

ProMounts is an ideal global platform to place fast prototyping and small batch orders. We have sales offices around the world, operating 24/7, to manage larger projects directly.

All countries can collect product using their own carriers at no additional cost. Please nominate your courier and account number in the order message. Exchange rates may fluctuate, updating on a daily basis. *** For small item/low cost orders, where items can be posted, rather than sent by trackable courier, please contact the sales office to get a competitive postal rate. We are a manufacturer's wholesaler supplying volume deliveries, priced accordingly ***

Our Promounts shop will help you access our full product range directly from a single source at highly competitive prices. The extensive range of slides, rails, drawer systems and tool-mounts are primarily used by industrial manufacturers and vehicle builders where strong, robust products are specified to meet very demanding applications. From this background we have created the widest selection of sliding systems available, anywhere, whatever your application is. Our products are supported by a team of highly experienced sales engineers who can be contacted for any technical advice on enquiries@gsfslides.com. We aim to respond immediately, regardless of time zone.

We are delighted to offer our Global Customers a buy online facility in £GBP to order from our extensive range at factory prices. We have a price conversion function to assist selection in multiple currencies. Many of the products are available ex stock from our UK warehouse in a few days, with the wider range manufactured and supplied within 4-5 weeks, or can be stocked for immediate call off against scheduled orders. Whether you need a pair for home use or 200 pairs for engineering production, we operate a flat rate shipping charge or customer collection anywhere in the world.

*Long Length Surcharge - Carriers now impose surcharges for deliveries of slides & rails over 1000mm, regardless of weight. Please contact us for a price to ship or collect an order which has products over 1000mm in length within it. This also applies to pallets which can only be sea-freighted.

**We now ship directly to Australia & New Zealand outside of our flat rate shipping programme due to fluctuating freight costs. Please note, our standard method of shipping throughout Europe is via DHL Economy Select 2-5 days depending upon destination. We aim to ship stocked product throughout the UK within 48 hours. Shipping to the USA and other zones is by airfreight up to 65kg and no more than 1.2 metres in length. Anything over 65kg, palletised or 1.2m will be shipped by seafreight and/or subject to surcharge. We will contact you to advise on the method. Sliding Systems reserves the right to choose which delivery option is available.

JANUARY 2021 – POST BREXIT: In line with UK Government & EU directives, there is no UK VAT (or resale tax) charged to customers ordering from within the European Union. This applies to all deliveries being made within the EU and agreed territories. Local purchase tax (VAT/TVA/USt…) may be charged at the discretion of each member state upon importation. We will supply all relevant commercial documents, along with our couriers, to ensure there are no delays in the clearance of your order.

By registering on our ProMounts site, this enables the customer to track orders, download invoices and re-purchase with stored product information.

Our standard method of shipping is by economy air-freight via DHL/FedEx, however on bulky items, palletised or lengths over 1,000mm we reserve the right to use sea-freight. The customer can pay a premium in these instances to guarantee a swift delivery when required. We can supply packed ex works UK for collection on all items or use customer accounts to ship. All orders are charged in £GBP and the customer is responsible to pay exchange rate costs brought by their own bank, if applicable. Currency conversions fluctuate daily, so please confirm prior to ordering. Please note, all orders outside of the European Union are are on a delivery duty unpaid (DDU) basis.

Customers outside of these regions can order online, at the same prices, for an ex works collection of their consignment. Please either supply your own carrier account details with the order or Sliding Systems will invoice at an agreed rate. NOTE THAT THE PRICES QUOTED WITHIN THESE REGIONS WILL NOT INCLUDE SHIPPING. THESE HAVE TO BE ARRANGED BY THE CUSTOMER SEPARATELY. THE SITE WILL ONLY CHARGE YOU FOR THE PRODUCTS PACKED READY FOR COLLECTION.

For OEM customers requiring quantity discounts against scheduled order cover, please contact our sales office (enquiries@gsfslides.com) and send an enquiry. We will respond immediately, regardless of time zone.

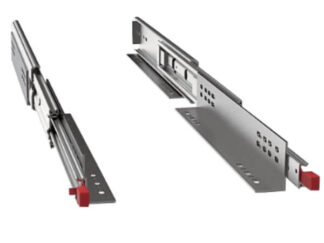

Low Cost Truck Base Mounts

Fully Locking

All Lengths From Stock

Sliding Systems At Home

We've put together a range of products suitable for home and DIY use for which we get the most enquiries. From under-stair cupboards to TV screens, stair gates, tool storage and pick-up truck drawers. These are our suggestions for the most economical way to get household DIY projects moving. Click on images for fast delivery of stocked product.

ABOUT US

Sliding Systems engineers have the experience to guide you through the selection process of choosing the right telescopic slide, linear rail or tilting drawer system. We have the widest selection of telescopic and drawer slides available, anywhere, from a few kilos to well over 4,000kg, across multiple ranges specifically designed to anticipate almost every demand.

CUSTOMERS

COMPANY

Sliding Systems,

Gledrid Industrial Park,

Chirk,

Wrexham,

LL14 5DG,

United Kingdom

Tel: +44 (0)1691 770303

© 2025 GSF Promounts All rights reserved | Website by Arise Media